Hedging Forex

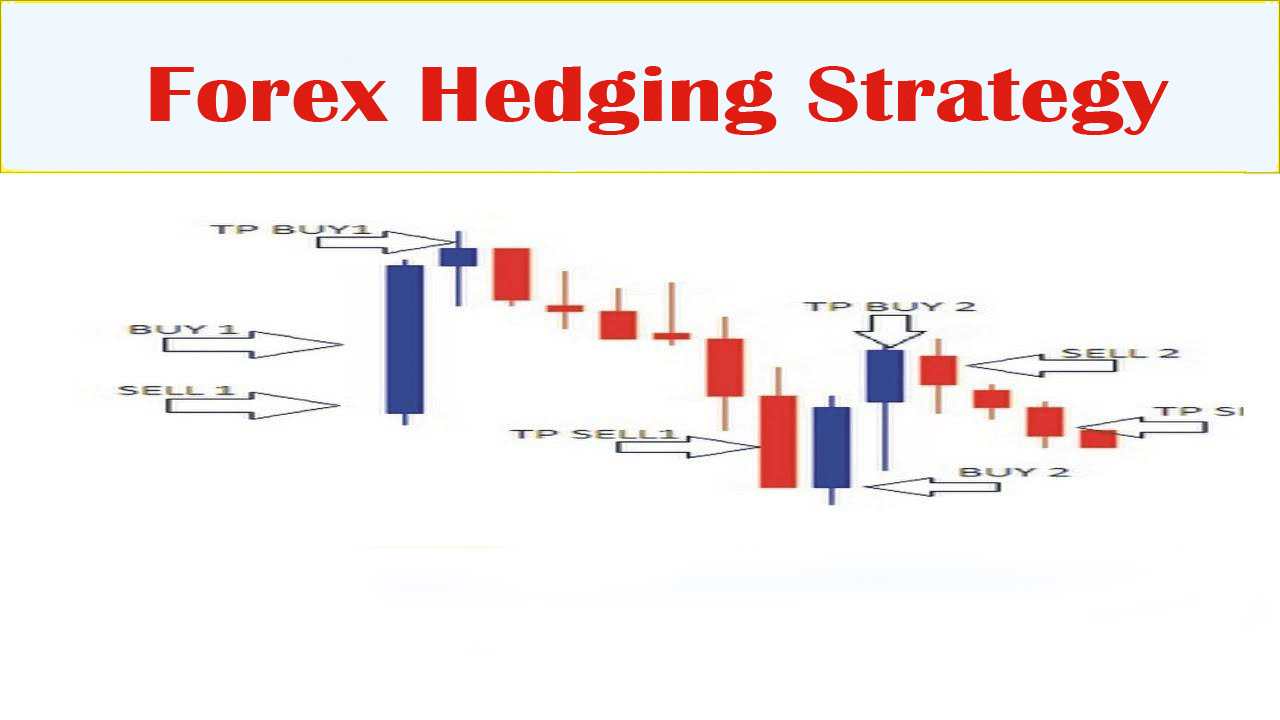

A forex hedge is a transaction implemented to protect an existing or anticipated position from an unwanted move in exchange rates. Pairs trading is an advanced forex hedging strategy that involves opening one long position and one short position of two separate currency pairs.

What Is Hedging In Forex With Example

What Is Hedging In Forex With Example

Hedging is a popular trading strategy deployed to protect opened positions in the forex market from adverse events.

Hedging forex. Hedging is a form of strategy that strives to minimize your risk whilst trading and protect you against unwanted price changes. What is hedging in forex? The advance forex hedging is an updated version of traditional forex hedging and it is used for online trading and protects the traders from the loss because it detects the points that shows the price levels where the prices are low.

A currency hedge could entail buying eurusd in the spot. Of course having such an idealized outcome has a price. This is all done in order to protect yourself against sudden and unexpected market movements.

There is a short scenario: In addition to positively correlated pairs, there can be used currency pairs with. Hedging is amongst the most utilized strategies to reduce and manage risk.

So, if the market is going up and you’re short, you might buy to temporarily hold the position until the market turns back in your favor. The forex hedging strategy is used when a party in market trading is going in loss then to convert this lossy movement into profit or for trend change.in simple words we can say that it is used to protect currencies from loss of moeny.this strategy is used for short term trading purpose and can also be used for long term but for both term there are different conditions.this best forex strategy. Un hedging forex réduit intrinsèquement votre exposition au marché financier.

Forex hedges are used by a broad range of market participants. Hedging with forex is a strategy used to protect one's position in a currency pair from an adverse move. When traders talk about hedging, what they usually mean is that they want to limit losses but still keep some upside potential.

That’s just one angle to understand what is forex hedging. Tindakan hedging resiko oleh perusahaan yang mengimpor barang dari eropa: Traders, as well as forex robots, deploy the short term protection strategy whenever there is concern that news or upcoming events would lead to adverse events that could trigger losses on an open position.

Vous pouvez prendre des positions que vous n'auriez pas pu prendre autrement. How to create a simple profitable hedging strategy. Hedging is when you try to profit from the basis change between the cash and futures market.

Kalau dalam postingan kami sebelumnya adalah membahas bagaimana untuk membuka lockingan atau hedging, kali ini kami akan mundur sedikit beberapa langkah dengan membahas mengenai hedging forex. If you want to know about a practical example of hedging, then we should mention how traders enter into a forex hedge. Forex hedging is, therefore, the process of trying to offset the risk of.

Ini merupakan teknik trading forex berisiko sangat tinggi, sehingga kamu harus berlatih pada akun demo dulu hingga mahir sebelum menerapkannya pada akun riil. If you are trading cash forex with a broker like forex.com, fxcm etc., you have no reason to hedge. Perusahaan importir menunggu pasokan paket dari eropa sejumlah tertentu dalam euro selama satu bulan.

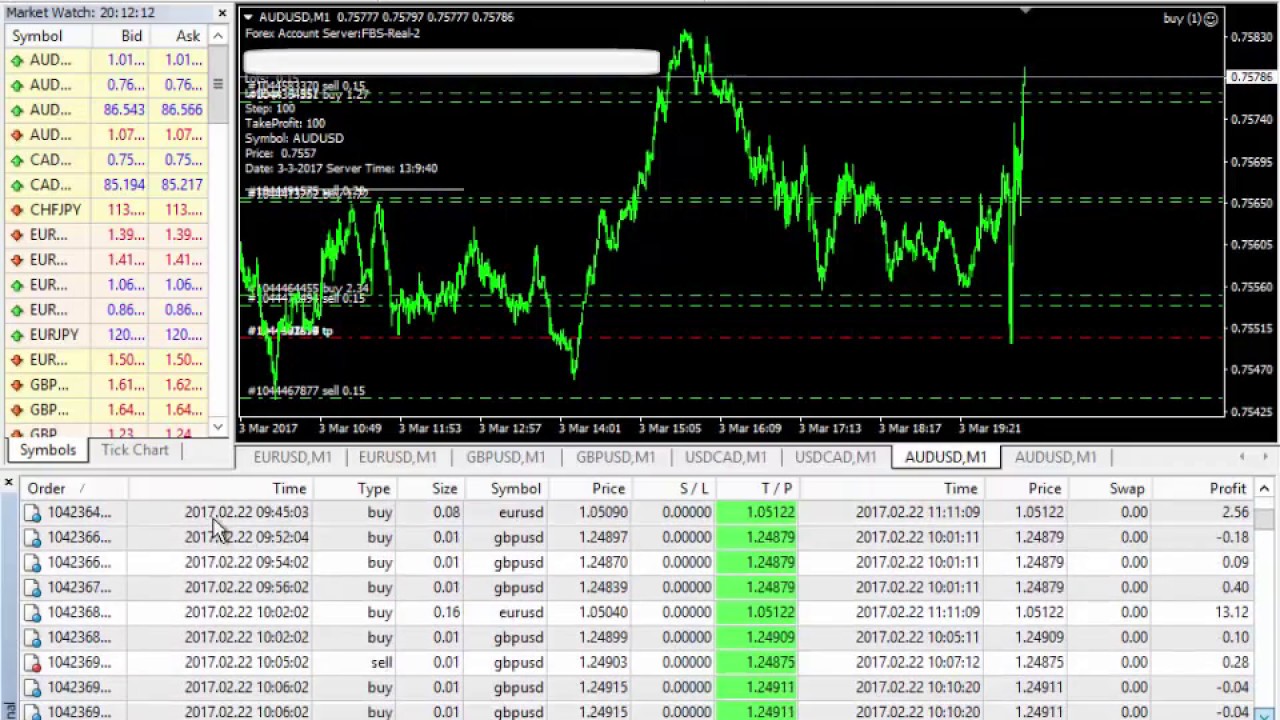

This increases the profit chances and decreases the loss probability. Hedging scalper is a new generation forex robot that works using the principle “buy cheap, sell high”. At the same time, you can also place a trade to sell the same pair.

Sebuah teknik yang sangat mendasar yang banyak digunakan oleh para trader untuk melakukan manajemen resiko, hasil akhirnya terkadang memang di luar perkiraan dengan mengalami kerugian walaupun kadang ada. Hedging is a whole other animal, and most likely not applicable to you. You could hedge instead of using a stoploss, but what is the use of that?

Open orders are grouped into baskets, which are very low correlated. The reason that hedging was introduced was for the traders to be able to insure themselves against a negative event.in order for a forex trader to hedge successfully, Untuk memulai hedging bukalah akun trading di grup perusahaan instaforex yang menyediakan layanan jasa trading di pasar forex.

On peut se retrouver au début d'une nouvelle tendance bien avant de voir les signaux de confirmation. Some brokers allow you to place trades that are direct hedges. The accounting rules for this are addressed by both the international financial reporting standards (ifrs.

Hedging is a very common trading strategy that almost all traders are familiar with it. Hedging forex is a strategy used to protect from losing trades resulting from an adverse move of a currency pair. Hedging as it applies to the forex market and trading, at its most basic form, is a strategy to protect you from losing big in a certain market position.there are many types of hedge that move from the very simple, to the more complex if you are an advanced trader, but the premise is the same.

Traders enter a particular trade to protect either already existing or expected positions from an adverse price movements in exchange rates of a certain currencies. A forex hedging robot is designed around the idea of hedging, which is based on opening many additional positions and buying and selling at the same time combined with trend analysis. Teknik hedging merupakan suatu strategi yang sering diterapkan untuk menyikapi posisi loss, jika sang trader enggan menggunakan fitur stop loss (sl).

Let’s take a look at the simplest strategies that traders employ. Forex hedging is used more to pause the profit or loss during a reversal. A foreign exchange hedge (also called a forex hedge) is a method used by companies to eliminate or hedge their foreign exchange risk resulting from transactions in foreign currencies (see foreign exchange derivative).this is done using either the cash flow hedge or the fair value method.

Traders usually close or reduce positions when wanting to avoid risky trading situations, but there are many opportunities where you want to minimize your exposure only for a short while. This strategy is a cinch to undertake, in that it only requires one to open a position going opposite to one’s current position. A direct hedge is when you are allowed to place a trade that buys one currency pair, such as usd/gbp.

Hedging forex strategy USD/JPY may,19,2020 استراتيجية

Hedging forex strategy USD/JPY may,19,2020 استراتيجية

Hedging Forex Descubre la estrategia de cobertura en trading

Hedging Forex Descubre la estrategia de cobertura en trading

Know About the Hedging in Forex AAG Markets

Know About the Hedging in Forex AAG Markets

Forex Hedging Strategy Explained FXCracked

Forex Hedging Strategy Explained FXCracked

Hedging forex forum and more equity rights issues and the

Hedging forex forum and more equity rights issues and the

hedging Forex strategy,Trading System,indicator,binary

hedging Forex strategy,Trading System,indicator,binary

Forex Hedging Strategy Two Currency Pairs Is The Best

Forex Hedging Strategy Two Currency Pairs Is The Best

HEDGING Forex for DUMMIES How SUCCESSFUL HEDGING FOREX

HEDGING Forex for DUMMIES How SUCCESSFUL HEDGING FOREX

Forex Scalping Hedging Strategy Forex Early Warning Trading

Forex Scalping Hedging Strategy Forex Early Warning Trading

Forex Hedging can save you from big losses Forex Winners

Hedge Forex EA Every Month 120 125 YouTube

Hedge Forex EA Every Month 120 125 YouTube

Hedging Forex EA1 Forex Robot Download Forex Robots

Hedging Forex EA1 Forex Robot Download Forex Robots

Best Hedging Forex Trading Strategies

Best Hedging Forex Trading Strategies

SUPER HEDGING FOREX EA Multiple chart Best EA Forex

SUPER HEDGING FOREX EA Multiple chart Best EA Forex

Reduce Your Risk How to Hedge Forex Like a Pro My

Reduce Your Risk How to Hedge Forex Like a Pro My

Forex Hedging Strategy Example Forex Success System

Forex Hedging Strategy Example Forex Success System

Tag forex « Start a Binary Option Broker Business Now

Tag forex « Start a Binary Option Broker Business Now

Hedging Forex Trading Forex Italia

Hedging Forex Trading Forex Italia

Amazing Forex Hedging Strategy 2015

Comments

Post a Comment