Forex Patterns

Chart patterns are used for forecasting in forex like they were used earlier, along with support and resistance levels. If you spot a continuation chart pattern during a trend.

Singapore Seminars Courses and Preview Harmonic Forex

Singapore Seminars Courses and Preview Harmonic Forex

Each chart pattern indicator has a specific trading potential.

Forex patterns. Forex trading patterns are divided in groups based on the potential price direction of the pattern. For continuation patterns, stops are usually placed above or below the actual chart formation. Each candlestick pattern mentioned in this article signifies a different movement or action in the market.

Get the forex chart patterns cheat sheet, learn how to differentiate similar patterns using highs and lows, and how to choose patterns that suits your trading style using the patterns' characteristics. They respond to specific conditions that produce similar results. Patterns technical analysis patterns patterns are being scanned in real time and presented in the table below (table refreshes automatically every 30 seconds).

Forex chart patterns (or forex candlestick formations) are structures of price movements that tend to replicate themselves in different periods and time frames. However, there are certain patterns you can look out for. Forex traders who study these patterns, their shapes, compositions, and meanings for prices can make decisions regarding buying and selling as they see these patterns take shape.

For example, when trading a bearish rectangle, place your stop a few pips above the top or resistance of the rectangle. For the forex trader, a critical aspect of their technical analysis is the reading of forex chart patterns. The wedge was one of the first forex chart patterns i began trading shortly after i entered the market in 2007.

We’ve listed the basic forex chart patterns, when they are formed, what type of signal they give, and what the next likely price move may be. As a result, forex traders spot chart patterns to profit from the expected price moves. In this tutorial, we will discuss the most important forex price action patterns, also called chart patterns, both names are equal.although i find the price action patterns name more meaningful.

There are three main types of chart patterns classified in forex technical charting. The trend continuation chart pattern appears when the price is trending. Here are some of the more basic methods to both finding and trading these patterns.

In our service you will always find the latest and most relevant patterns on any pair and any timeframe. Patterns are born out of price fluctuations, and they each represent chart figures with their own meanings. You will often see reference in forex commentaries to flags, wedges, and pennants, all forms of the triangle.

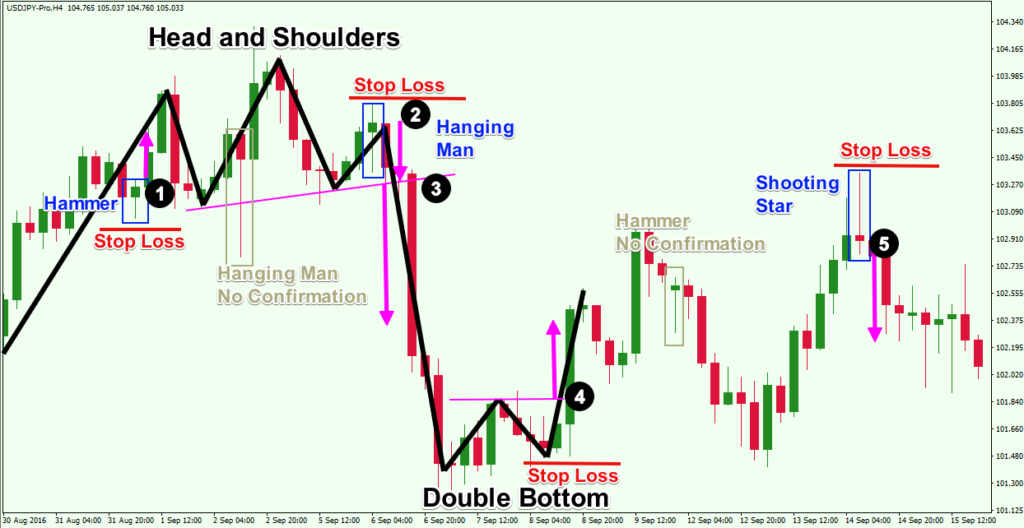

Forex chart patterns, which include the head and shoulders as well as triangles, provide entries, stops and profit targets in a pattern that can be easily seen. Triangles are formed when you can easily draw both a support and resistance line and they can be extended to come together in an apex. Forex candlestick patterns bottom line.

Chart patterns are a crucial part of the forex technical analysis. Forex harmonic patterns are geometric price formations that derive from fibonacci retracement or. As swing traders, we aim to profit from both up and down.

When used in conjunction with trends and simple support/resistance levels, forex candlestick patterns become one of the simplest and most powerful analysis tools available. Beginner swing traders will want to spend time studying key bullish forex chart patterns when developing their forex swing trading strategies. Bilateral chart patterns are a bit more tricky because these signal that the price can move either way.

These chart patterns form the basis of technical analysis conducted by numerous traders around the world for executing profitable trades. Please note that some patterns should be confirmed with the price, for example a pattern may be valid only if occurs during an uptrend or a downtrend. In that line, traders follow those patterns to identify trading opportunities.

However, understanding is not enough. In my onion, patterns are the most accurate tool of graphical analysis. You only need to discover a price pattern in the chart, and, if it works out, enter a trade and enjoy your profit.

A deep understanding of these patterns provides the trader with the best entry and exit points and enables the trader to benefit from the entire trend movement. Like we promised, here’s a neat little cheat sheet to help you remember all those chart patterns and what they are signaling. First we will introduce the main classic chart patterns, then the fibonacci based chart patterns.

Forex patterns & probabilities : However, there is more than one kind of triangle to find, and there are a couple of ways to trade them. The more traditional classic patterns number over a hundred.

Forex patterns and stock market patterns are similar to each other as the trader’s sentiment mostly drives these markets. Spotting chart patterns is a popular hobby amongst traders of all skill levels, and one of the easiest patterns to spot is a triangle pattern. While some swing traders might specialize in swing trading stocks, options or commodity futures, this post will focus on trading bullish chart patterns as part of a forex trading strategy.

Traders and analysts forecast future price movements in forex using different chart patterns. These formations can range from the most basic ones that consist of a few trend lines only, such as triangles, wedges, flags, pennants, double top/bottom, to more advanced setups like harmonic patterns.

Nonstandard Forex patterns special view on habitual

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg) Most Commonly Used Forex Chart Patterns

Most Commonly Used Forex Chart Patterns

The 5 Most Popular Forex Chart Patterns Blackwell Global

The 5 Most Popular Forex Chart Patterns Blackwell Global

Forex Repeating Patterns Forex News Ea Free

Forex Repeating Patterns Forex News Ea Free

Introduction to harmonic price patterns. investingchef

Introduction to harmonic price patterns. investingchef

chartpatternsbestforexbrokertresorfxpepperstone

What are Some Frequently Used Forex Chart Patterns

What are Some Frequently Used Forex Chart Patterns

Forex Trading Introduction of Harmonic Patterns Forex

Forex Trading Introduction of Harmonic Patterns Forex

What is the best candlestick pattern for trading Forex

Mw Pattern Forex « Start a Binary Option Broker Business Now

Mw Pattern Forex « Start a Binary Option Broker Business Now

What Are The Most Frequently Used Forex Chart Patterns?

What Are The Most Frequently Used Forex Chart Patterns?

Reversal models in the forex market ForeX Technical

Reversal models in the forex market ForeX Technical

10 Best images about Trading patterns on Pinterest

10 Best images about Trading patterns on Pinterest

Types of Chart Patterns for Binary Options Trading

Trading infographic There are many Forex Chart patterns

Trading infographic There are many Forex Chart patterns

Forex Chart Patterns, Improve Your Trading Forexearlywarning

Top Forex Reversal Patterns that Every Trader Should Know

Top Forex Reversal Patterns that Every Trader Should Know

bat pattern forex Google Search ForexBasics Bat

bat pattern forex Google Search ForexBasics Bat

Comments

Post a Comment